Currently Empty: 0.00zł

Prepaid Expenses Guide: Accounting, Examples, Entries & More Explained

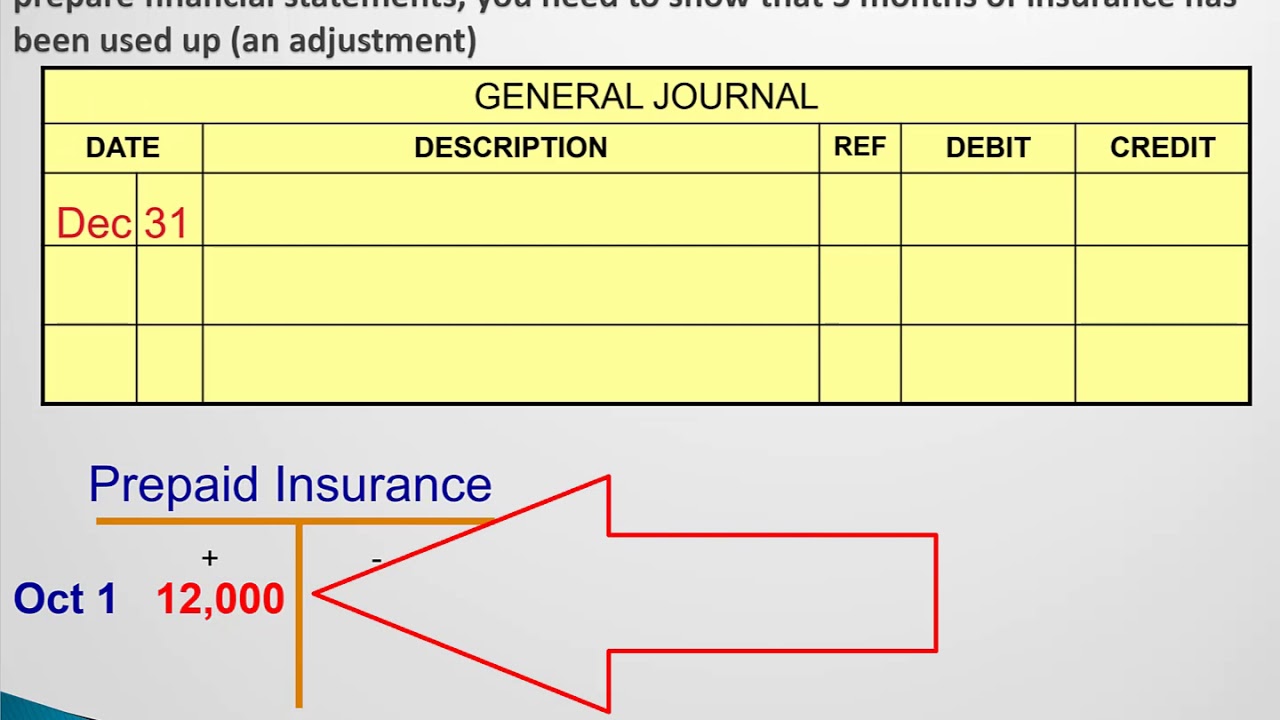

Assume that a company’s annual premium on its liability insurance policy is $2,400 and is due on the first day of each year. When the $2,400 payment is made on January 1, the company debits Prepaid Insurance and credits Cash. It also sets up automatic monthly adjusting entries to debit Insurance Expense for $200 and to credit Prepaid Insurance for $200 on the last day of each month. Likewise, the journal entry for the insurance expense that is converted from the expiration cost of prepaid insurance is the debit of the insurance expense account and the credit of the prepaid insurance account. Due to the nature of certain goods and services, prepaid expenses will always exist. For example, insurance is a prepaid expense because the purpose of purchasing insurance is to buy proactive protection in case something unfortunate happens in the future.

How long can prepaid expenses be reported as an asset?

Organizations typically use a prepaid expense ledger to monitor the total amount of money spent on prepayments, when payments are due, and when they will be received. This helps ensure that companies are accurately accounting for their assets while also staying up-to-date with any upcoming liabilities. Prepaid expenses are recorded as an asset on a company’s balance sheet because they represent future economic benefits. The payment of expense in advance increases one asset (prepaid or unexpired expense) and decreases another asset (cash). When the insurance coverage comes into effect, it is moved from an asset and charged to the expense side of the company’s balance sheet. In this case, the company’s balance sheet may show corresponding charges recorded as expenses.

Prepaid Expenses

Since adjusting entries involve a balance sheet account and an income statement account, it is wise to monitor the balances in both Prepaid Insurance and Insurance Expense throughout the year. The amount that has not yet expired should be the balance in Prepaid Insurance. Suppose that Smith Company, which has a yearly accounting is prepaid insurance a contra asset period ending on 31 December, purchases a two-year comprehensive insurance policy for $2,400 on 1 April 2019. This payment represents a prepaid expense, but its classification as an asset might surprise you. The second journal entry shows how 1/12th of this amount is charged to expense in the first month of the coverage period.

Prepaid expenses vs. accrued expenses

Prepaid insurance is important because a business should correctly record all of its transactions and resources to have accurate financial statements. Although Mr. John’s trial balance does not disclose it, there is a current asset of $3,200 on 31 December 2019. XYZ company needs to pay its employee liability insurance for the fiscal year ending December 31, 2018, which amounted to $10,000. The company has paid $10,000 of the insurance premium for the entire year at the beginning of the first quarter. You may want to set up an amortization table to track the decrease in the account over the policy term and to determine what the journal entries will be. In exchange, the insurance company usually offers the customer a discount on the premium price, so the business saves money on the policy.

Which of these is most important for your financial advisor to have?

The company records the refund with a debit to Cash and a credit to Prepaid Insurance. At December 31, the balance in Prepaid Insurance will be a credit balance of $120, consisting of the debit of $2,400 on January 1, the 12 monthly credits of $200 each, and the $120 credit on July 1. Prior to issuing the December 31 financial statements, the company must remove the $120 credit balance in Prepaid Insurance by debiting Prepaid Insurance and crediting Insurance Expense.

- This is usually done by dividing the total premium paid by the coverage period, which may be expressed in months or years.

- A prepaid expense, on the other hand, is any good or service that you’ve paid for but have not used yet.

- That’s because most prepaid assets are consumed within a few months of being recorded.

- When a company pays its insurance payments in advance, it makes a debit entry to its prepaid insurance asset account.

Entities following US GAAP and hence issuing GAAP-compliant financial statements are required to use accrual accounting. Accrual accounting adheres to the matching principle which requires recognizing revenue and expenses in the period they occur. For example, if a business had purchased six months of insurance and decided to cancel the policy after two months, it could redeem the value of the four remaining unused months of coverage.

Prepaid insurance is initially recorded as a current asset in the general ledger. Over time, as coverage lapses, adjusting journal entries are made to transfer the relative insurance premium amount to expenses. A prepaid expense is a good or service that has been paid for in advance but not yet incurred.

FastTrack company buys one-year insurance for its delivery truck and pays $1200 for the same on December 1, 2017. Now that the company has prepaid for services to be used, it is classified as an asset. It refers to the portion of the outstanding insurance premium paid by the company in advance and is currently not due. Typically, when an organization obtains a software subscription, the software vendor incentivizes the organization with favorable pricing if they sign a longer-term commitment and pay for the total contract upfront. Would you rather pay $200 each month for one year or prepay $1,500 for the entire year and save $900?

The following journal entry will be passed and reflected in the books of accounts of XYZ company. The premium covers twelve months from 1 September 2019 to 31 August 2020, i.e., four months of 2019 and eight months of 2020. It would be incorrect to charge the whole $4,800 to 2019’s profit and loss account. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

His focus on customer education ensures that insurance information is not only accurate but also easily understandable for everyone.